The Reserve Bank of India (RBI) has unveiled a new centralized online portal called UDGAM to tackle the problem of unclaimed bank deposits. This new system enables people to swiftly find unclaimed funds from various banks all in one place.

By integrating UDGAM, RBI embraces the digital age, making it easier for customers to access banking services. This online hub ensures unclaimed money is returned to its rightful owners.

Earlier, on April 6, the RBI shared plans about creating this online portal due to the growing number of unclaimed deposits. They’ve also been raising public awareness to encourage individuals to claim their funds.

Sanchit Garg, the CEO of GLC Wealth, mentioned that the UDGAM platform offers a straightforward way for individuals to discover dormant accounts. This move is an extension of a prior initiative where banks aimed to help the top 100 account holders with unclaimed funds in their districts.

The portal’s main goal is to help people find and reclaim their unclaimed funds. It’s a collaborative effort between Reserve Bank Information Technology Pvt Ltd, Indian Financial Technology & Allied Services, and several banks.

Currently, details from seven banks, including Central Bank of India, DBS Bank India Limited, and State Bank of India, can be accessed on UDGAM. More banks will be added to the platform by October 15, 2023.

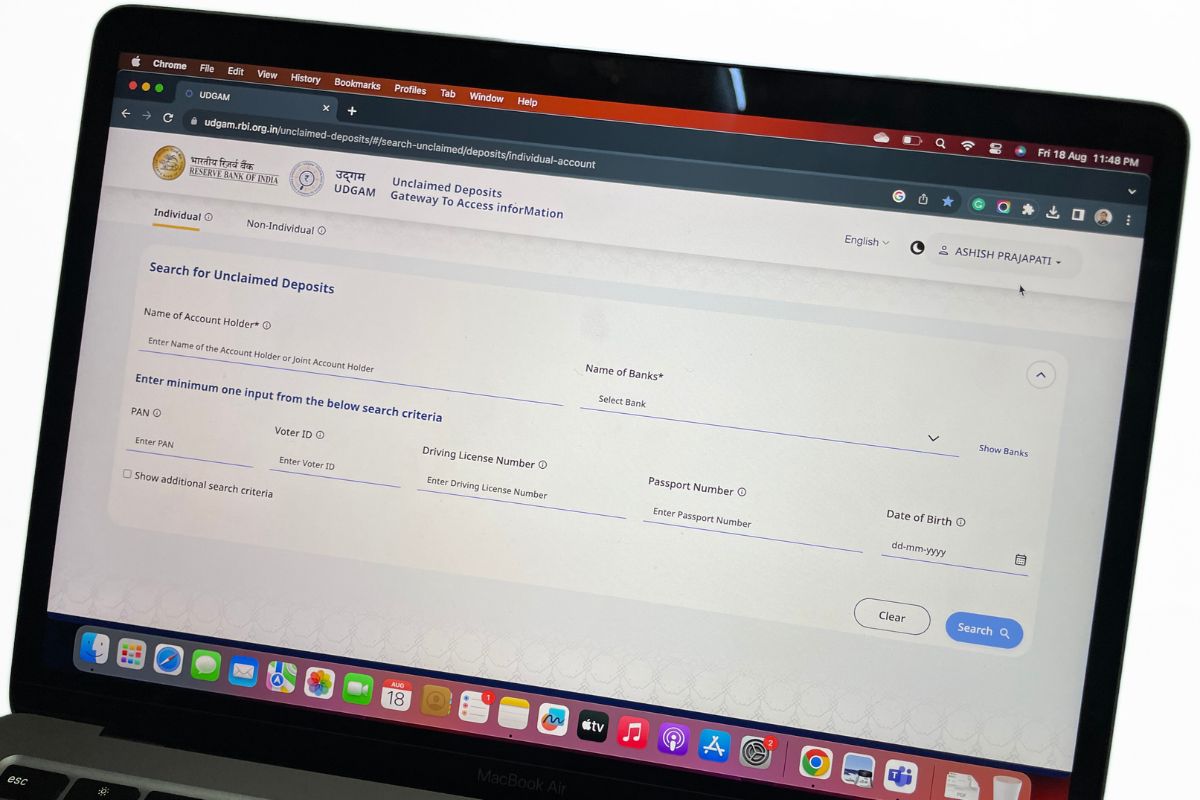

To use the portal:

- Go to udgam.rbi.org.in and register with your mobile number.

- Set up your profile by entering your name and creating a password.

- Validate your account with the OTP sent to your phone.

- Log in using your credentials.

- Start your search by entering the account holder’s name and relevant ID proofs.

Garg believes that this platform will be incredibly beneficial for those who have multiple accounts and might have forgotten about some.

In summary, UDGAM isn’t just a digital service but a step towards transparency in finance. It helps ensure unclaimed funds are located, strengthening the public’s trust in banks. This initiative showcases the RBI’s commitment to modernising India’s financial landscape.